real estate tax shelter act 1986

Tax and sewer payments checks only. Referred to as the second of the two Reagan tax cuts the Economic Recovery Tax Act of 1981 being the first the bill was also officially sponsored by Democrats Richard.

Juvenile Services Center Hamilton County In

The 1986 act limited the deduction of.

:max_bytes(150000):strip_icc()/GettyImages-88305470-6152a026f81d4a9198db0eeb8cbca446.jpg)

. All real estate losses are considered passive losses losses that are incurred through an enterprise which the investor is not actively involved. Abstract- he Tax Reform Act of 1986 has contributed to the decline of the real estate industryThe changes that have contributed to the decline of the industry include the elimination of the capital gains tax differential the increase in the period for writing off taxes for depreciable real. While the Code has been totally revamped the investors of real estate seem to be the main target of the Act.

Changes in capital gain treatment depreciation limits on passive loss deductions limits on investment interest deductions and the extension of the at-risk. INTRODUCTION The Tax Reform Act of 19861 the TRA86 curtailed significant tax benefits previously available to real estate investors2 One ofthe most important changes of the TRA86 was the extension of the at-risk rules. We would like to show you a description here but the site wont allow us.

612 billion to 384 billion between 1986 and 1989 even though partnership losses for real estate operators and lessors ofbuildings and for oil and gas extractiontwo industries associated with tax sheltering only declined from 579 billion to 568 billion over the same period 123. The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986. No cash may be dropped off at any time in a box located at the front door of Town Hall.

THE DOOR CLOSES ON TAX-MOTIVATED INVESTMENTS Olivia S. Tax Reform Act of 1986 by Cordato Roy E. 4525 14 Shelter Bay Condos Edgewater New Jersey Located directly on the Hudson River Shelter Bay Condos offers 60 townhouse residences containing large 2 2 3-Br duplex and triplex units.

Before 1986 wealthy individuals could use passive income losses from a real estate tax shelter to offset active income. In contrast to the conventional wisdom real estate activity in the aggregate is not disfavored by the 1986 Tax Act. However sucha response is not surprising since.

Education and professional enrichment programs are developed implemented or sponsored to meet the continual needs of the membership. The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to. Congress passed the Tax Reform Act of 1986 TRA PubL.

Regular rental and commercial activity will be slightly disfavored while historic and old rehabilitation activity will be greatly disfavored. Westin The Tax Reform Act 2 of 1986 PL. The 1986 Tax Reform Act has made sweeping changed in the nations tax code.

The 1986 Tax Reform Act has made sweeping changed in the nations tax code. Shelter Bay Condos was constructed in 1983 these condos are exceptionally large spacious luxury homes. Changes in capital gain treatment depreciation limits on passive loss deductions limits on investment interest deductions and the extension of the at-risk rules to real estate have dealt a.

While the Code has been totally revamped the investors of real estate seem to be the main target of the Act. Destroying real estate through the tax code. THE AT-RISK RULES UNDER THE TAX REFORM ACf OF 1986.

The association meets monthly to address real property tax and assessment issues throughout New Jersey. Programs are open to County Tax Board Commissioners Administrators Tax Board office personnel Municipal. The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term.

Tax Reform Act 1 of 1986 Richard A. Unfortunately the Tax Reform Act of 1986 has limited this tax shelter. In contrast owner- occupied housing far and.

Within the broad aggregate however widely different impacts are to be expected. 2085 implemented a tax code that at once swept away and reenacted its predecessor. Passive losses can now only be used to offset passive income.

To pay your sewer bill on line click here. In other words if you show a loss on one property of 50000 it. 2085 enacted October 22 1986 to simplify the income tax code broaden the tax base and eliminate many tax shelters.

Tax Efficient Investing 7 Ways To Minimize Taxes And Keep More Of Your Profits Bankrate

How Older Adults Can Benefit From The Earned Income Tax Credit

Tilles Park St Louis County Website

The Low Income Housing Tax Credit Program Costs More Shelters Less Npr

11 Ways The Wealthy And Corporations Will Game The New Tax Law Center For American Progress

Spanish Lake Park St Louis County Website

:max_bytes(150000):strip_icc()/GettyImages-88305470-6152a026f81d4a9198db0eeb8cbca446.jpg)

Section 1250 Definition Tax Laws

Bella Fontaine Park St Louis County Website

Bella Fontaine Park St Louis County Website

G O P Governors Cause Havoc By Busing Migrants To East Coast The New York Times

Public Parks Frenchtown Charter Township

How Is A Tax Shelter Calculated In Real Estate

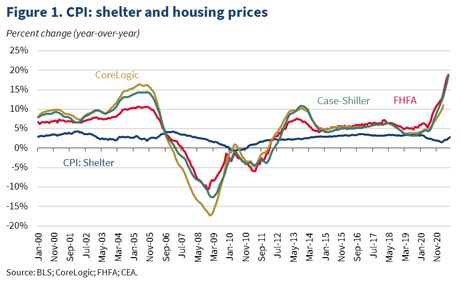

Housing Prices And Inflation The White House

Comments On New York City S Executive Budget For Fiscal Year 2023 And Financial Plan For Fiscal Years 2022 2026 Office Of The New York City Comptroller Brad Lander

Parsonsfield Me Real Estate Homes For Sale Re Max